As of 30 Apr 2024

Price Data

| Unit class | A |

|---|---|

| Min. unit | 1 |

| Price per unit |

Standing Data

| Since start | 8.41% |

|---|---|

| Fund type | UK OEIC |

| Launch date | Aug 2019 |

| Initial charge | 0.25% |

| Investment sector | North American equities |

Key Statistics

| Cumulative Return | 8.41% |

|---|---|

| Annualized Return | 1.72% |

| 5 Day Return | -0.43% |

| 10 Day Return | 0.58% |

| Best Return | 6.69% |

| Worst Return | -7.39% |

| Maximum Drawdown | -30.28% |

| Annualized Volatility | 16.86% |

Fund Aim

Financial Science is a systematic fund focused on liquid securities. The core algorithmic engine applies machine learning to a wide range of fundamental, momentum and other data to select undervalued stocks at reduced volatility across a risk adjusted portfolio.

This aims to allocate capital to:

- typically 40 – 100 long equity positions

- high quality businesses with sustainable profit and cashflow

- businesses without significant leverage

- companies at attractive valuations

- companies more able to withstand a significant market downturn

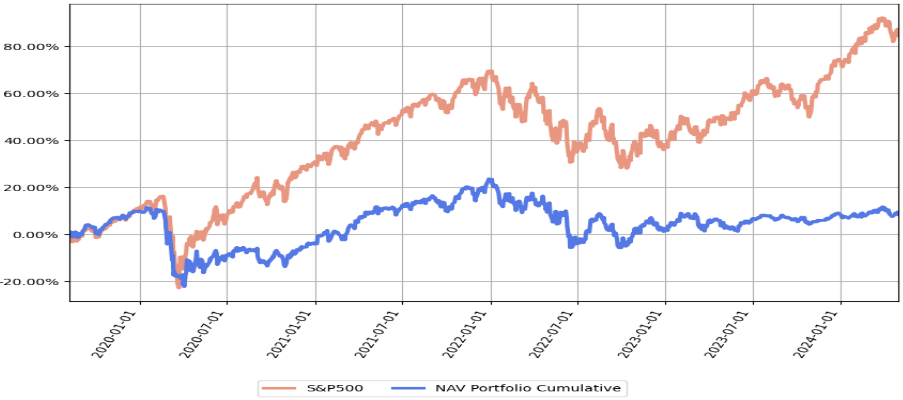

Performance, % Total Returns

| Apr 2024 | YTD | 2023 | 2022 | Inception to 2024-04-30 | Annualised to 2024-04-30 | |

|---|---|---|---|---|---|---|

| Fund | -2.98% | -0.12% | 6.11% | -16.88% | 8.41% | 1.72% |

| S&P 500 | -4.03% | 5.94% | 26.19% | -18.17% | 84.50% | 13.81% |

| Cash | 0.44% | 2.24% | 5.14% | 1.70% | 10.65% | 2.16% |

Monthly Performance Table, % Total Returns

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Totals | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2019 | 0.53% | 2.57% | 1.75% | 2.74% | 1.74% | 9.66% | |||||||

| 2020 | -2.72% | -10.23% | -13.63% | 8.25% | 0.60% | 1.22% | 2.16% | -0.59% | -3.78% | -3.24% | 8.08% | 3.43% | -12.11% |

| 2021 | 0.61% | 0.65% | 7.59% | 3.60% | 2.41% | 0.01% | 2.44% | 1.25% | -4.95% | 6.68% | -2.07% | 7.24% | 27.69% |

| 2022 | -6.38% | -1.28% | 0.90% | -4.68% | -0.83% | -11.66% | 10.75% | -3.44% | -8.09% | 8.87% | 4.28% | -4.34% | -16.68% |

| 2023 | 4.84% | -0.69% | -0.70% | -0.83% | -3.51% | 5.21% | 1.47% | -0.28% | -1.08% | -1.88% | 1.42% | 2.34% | 6.11% |

| 2024 | -0.91% | 1.70% | 2.15% | -2.98% | -0.12% |

The target fund performance (see tearsheets for historics) is

- annual return > 7.5% net

- annualised volatility < 15%

- maximum drawdown < 45%

Disclaimer: A Key Investor Information Document and an English language prospectus for the Financial Science Fund are available via the Financial Science website or on request and investors should consult these documents before purchasing shares in the fund. Past performance is not necessarily a guide to future performance. Any forecasts or backtests are for illustrative purposes only and are not to be relied upon as advice or interpreted as a recommendation. The value of investments and the income from them may fall as well as rise and be affected by changes in exchange rates, and you may not get back the amount of your original investment. Financial Science does not offer investment advice or make any recommendations regarding the suitability of its product. None of the information in this factsheet constitutes investment, legal, tax or other advice, nor should it be relied upon in making an investment decision. Copyright 2022 Financial Science

Factsheet Archive

| 2024 Factsheets | 2023 Factsheets | 2022 Factsheets | 2021 Factsheets | 2020 Factsheets | 2019 Factsheets |

|---|---|---|---|---|---|

| Dec 2023 | Dec 2022 | Dec 2021 | Dec 2020 | Dec 2019 | |

| Nov 2023 | Nov 2022 | Nov 2021 | Nov 2020 | Nov 2019 | |

| Oct 2023 | Oct 2022 | Oct 2021 | Oct 2020 | Oct 2019 | |

| Sep 2023 | Sep 2022 | Sep 2021 | Sep 2020 | Sep 2019 | |

| Aug 2023 | Aug 2022 | Aug 2021 | Aug 2020 | Aug 2019 | |

| Jul 2023 | Jul 2022 | Jul 2021 | Jul 2020 | ||

| Jun 2023 | Jun 2022 | Jun 2021 | Jun 2020 | ||

| May 2023 | May 2022 | May 2021 | May 2020 | ||

| Apr 2024 | Apr 2023 | Apr 2022 | Apr 2021 | Apr 2020 | |

| Mar 2024 | Mar 2023 | Mar 2022 | Mar 2021 | Mar 2020 | |

| Feb 2024 | Feb 2023 | Feb 2022 | Feb 2021 | Feb 2020 | |

| Jan 2024 | Jan 2023 | Jan 2022 | Jan 2021 | Jan 2020 |